Tokenizing Real Estate: Transforming Ownership in Property

Real Estate Tokenization has emerged as a groundbreaking concept, revolutionizing the traditional landscape of property ownership. This innovative approach leverages blockchain technology to tokenize real estate assets, offering new opportunities for investors, enhancing liquidity, and redefining how people engage with property ownership.

The Basics of Real Estate Tokenization

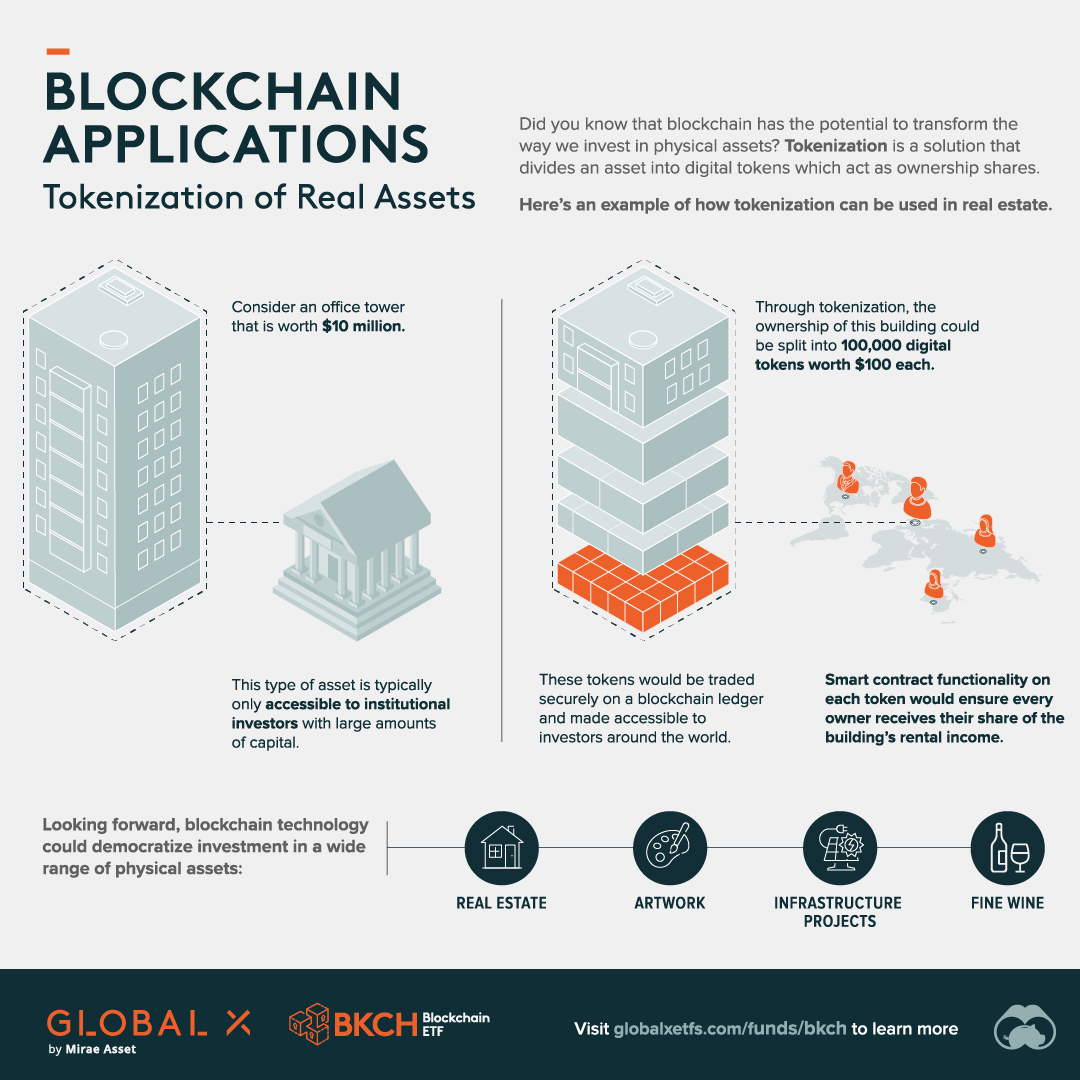

Real Estate Tokenization involves the issuance of digital tokens that represent ownership or shares in a real estate asset. Each token is backed by a portion of the property, providing investors with a fractional ownership stake. This process is facilitated by blockchain, a decentralized and secure technology that ensures transparency, immutability, and efficiency in transactions.

Enhanced Liquidity and Accessibility

One of the primary advantages of Real Estate Tokenization is the enhanced liquidity it brings to traditionally illiquid assets. By fragmenting property ownership into tokens, investors can buy and sell fractions of real estate assets, facilitating transactions that were once cumbersome and time-consuming. This increased liquidity opens up real estate investments to a broader audience of investors.

Fractional Ownership Opportunities

Real Estate Tokenization introduces the concept of fractional ownership, allowing investors to own a share of high-value properties. This democratization of real estate investment enables individuals to participate in markets that were previously reserved for institutional investors or high-net-worth individuals. Fractional ownership lowers the barrier to entry, making real estate investment more inclusive.

Efficiency and Cost-Effectiveness

The use of blockchain technology in Real Estate Tokenization streamlines the entire investment process, reducing administrative complexities and associated costs. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate processes such as property transfers, rental income distribution, and other transactions. This automation improves efficiency and reduces the need for intermediaries.

Global Investment Opportunities

Real Estate Tokenization transcends geographical boundaries, providing investors with access to a global portfolio of properties. Tokenized assets can be traded on digital platforms, allowing investors to diversify their real estate portfolios internationally without the constraints of traditional real estate transactions. This globalization of real estate investment opportunities is a key aspect of the transformative nature of tokenization.

Increased Transparency and Security

Blockchain technology ensures a high level of transparency and security in Real Estate Tokenization. Every transaction and ownership transfer is recorded on the blockchain, creating an immutable and transparent ledger. This transparency reduces the risk of fraud and enhances the overall security of the investment process, fostering trust among investors.

Democratizing Real Estate Development

Real Estate Tokenization not only impacts investment but also transforms the real estate development landscape. Developers can tokenize projects, allowing them to raise capital by selling tokens representing future revenue from the developed property. This democratization of real estate development funding broadens the sources of capital, potentially accelerating project timelines and increasing innovation.

Challenges and Regulatory Considerations

While Real Estate Tokenization offers numerous benefits, it is not without challenges. Regulatory frameworks for tokenized assets are still evolving, and navigating legal considerations is crucial. Additionally, the nascent nature of the technology may pose risks, requiring a careful balance between innovation and investor protection. It is essential for participants in this space to stay informed and compliant with evolving regulations.

The Future Landscape of Real Estate Investment

Real Estate Tokenization is poised to reshape the future landscape of real estate investment. As the technology matures and regulatory frameworks evolve, we can expect increased adoption and integration into mainstream investment practices. The transparency, efficiency, and accessibility offered by tokenization have the potential to redefine how individuals and institutions engage with real estate assets.

Explore Real Estate Tokenization at Gillian Cunningham Real Estate Agent McKinney TX

To delve deeper into the transformative world of Real Estate Tokenization, visit Gillian Cunningham Real Estate Agent McKinney TX. Discover how this innovative approach is reshaping property ownership, unlocking new possibilities for investors, and contributing to the evolution of the real estate industry.